| The short answer is ‘Yes!’ but there are some things you need to know. |

| While there are all kinds, types, brands, styles, etc. of machine guns, there is really only one important distinction that needs to be made… When was the machine gun manufactured? The reason that the date is so important, is because a law was passed in 1986 that made the manufacture of most machine guns illegal. However, machine guns manufactured prior to 1986 were grandfathered, so they can be legally transferred (bought & sold). |

| The 1986 law effectively divided machine guns into two distinct classes: Machine Guns manufactured before May 19, 1986, and Machine Guns manufactured on or after May 19, 1986 |

| Pre 1986 Machine Guns |

| You have two options when it comes to purchasing a machine gun that was manufactured before 1986. 1st – Purchase with a Form 4, 2nd – Get a C & R License. We will cover each of these methods in a bit more detail below. |

| Purchase using a Form 4 Application |

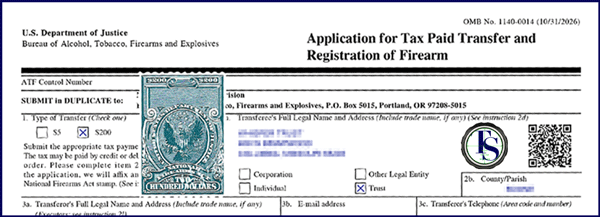

| To purchase a machine gun using a Form 4, all you need to do is submit a Form 4 Application to the ATF. And, of course, you need to verify it’s legal to own machine guns in your state. There are some Pros and Cons to this method of purchasing a machine gun: |

| Pros: |

| ✓ |

It is a fairly simple process – Just Create your Gun Trust, fill out your Form 4, then pick up your machine gun when you receive your Tax Stamp. For detailed instructions you can read our article Ten Steps to a Tax Stamp. |

| ✓ |

Pre 1986 Machine Guns are transferable – This means you can sell your machine gun down the road. But, why would you ever want to do that?! |

| ✓ |

Easy to come by – There are lots of pre 1986 machine guns on the market. |

| Cons: |

| ✓ |

The biggest negative to this method is the expense. For example, a Fully-Automatic Colt M4 can easily cost $30,000. |

| ✓ |

The farther we get from 1986, the fewer machine guns you’ll find for sale. |

| ✓ |

Another negative is that these guns are at least 30 years old. That means they’ve had thousands upon thousands of rounds fired through them. Gins have a limited life-span and getting replacements parts for these guns (especially for the fully-automatic mechanisms) can be a serious pain. |

| Curios & Relics License |

| To be considered a Curio & Relic by the ATF, a machine gun must meet one of the following conditions: |

| It must have been manufactured at least 50 years ago; or |

| It must be certified as a curio or relic of museum interest by the curator of a municipal, State, or Federal museum that exhibits firearms; or |

| It must derive a substantial amount of its monetary value from the fact that it is novel, rare, bizarre, or associated with some historical event, period, or figure. |

| You will have to obtain a Type 03 FFL – Collector of Curios and Relics, which costs $30 for a 3-year license. Getting a Type 03 FFL is easier than other types of FFLs, but you are more limited in what you can do. Just like the Form 4 method, there are some Pros and Cons to purchasing a machine gun with a C & R license: |

| Pros: |

| ✓ |

You can buy and sell curios or relics at any location |

| ✓ |

You can buy and sell curios or relics from/to an individual residing in the same State, who is not otherwise prohibited by the GCA, |

| ✓ |

You can buy and sell curios or relics from/to other Federal firearms licensee in any State |

| Cons: |

| ✓ |

C & R firearms are usually expensive |

| ✓ |

By definition, C & R firearms are extremely old |

| ✓ |

You can’t “engage in the business” of buying and selling curios and relics, which means you can’t buy and sell to earn a living |

| ✓ |

You can’t acquire firearms other than curios or relics using a collector’s license. |

| ✓ |

Licensed collectors have no special privileges with regard to firearms that are not curios or relics. |

| Post 1986 Machine Guns |

| There are two ways to acquire a machine gun that was manufactured after 1986. You can buy a post 1986 machine gun if you have a Type 1 Federal Firearms License and a Class 3 Special Occupational Tax (Dealer of NFA Firearms). Or, you can build a machine gun if you have a Type 7 Federal Firearms License and a Class 2 Special Occupational Tax (Manufacturer of NFA Firearms). But, just like pre ’86 machine guns, there are some big considerations to take into account. |

| Buying Machine Guns Manufactured after 1986 |

| A Dealer of NFA Firearms can purchase “Dealer Sample” machine guns that were manufactured after 1986, but there are definitely some things you need to consider: |

| Pros: |

| ✓ |

By far the biggest benefit is the price. The same Fully-Automatic Colt M4 ($30,000 in the previous example) may cost as little as $1,000. |

| ✓ |

You are buying a brand new machine gun – not some 50 year-old piece of scrap metal |

| ✓ |

You can easily obtain silencers, SBR’s, SBS’s, etc., without paying the $200 tax for each item. |

| Cons: |

| ✓ |

The process of becoming a Dealer of NFA Firearms requires obtaining your Federal Firearms License (FFL) and then paying your Special Occupation Tax (SOT). The process involves a lot of paperwork and an interview with an ATF Investigator. |

| ✓ |

The initial cost of your Type 01 FFL is $200. The license is good for three years, then costs $90 to renew for each three-year period. The cost of the SOT is $500 each year. If you don’t pay the fee every year, you have to turn over all of your NFA items to the ATF. |

| ✓ |

You need an ATF Law Letter to purchase a dealer sample machine gun. In order to be approved to possess a Dealer Sample machine gun, you have to obtain a letter from a Chief Law Enforcement Officer that states the law enforcement agency wants you to demonstrate a machine gun for them. |

| ✓ |

You need to get a Law Letter for each machine gun that you want to purchase and Law Letters are hard to come by. CLEO’s don’t want to be held responsible for putting fully automatic machine guns into circulation. |

| ✓ |

You can never sell your machine gun to anyone other than another Class 3 Dealer. |

| Manufacturing Machine Guns |

| To manufacture a machine gun you must have a Type 7 Federal Firearms License and a Class 2 Special Occupational Tax (Manufacturer of NFA Firearms). Once you become a Manufacturer of NFA Firearms, you can build all the “dealer Sample” machine guns you want. But… you guessed it… there are some major drawbacks to this route: |

| ✓ |

The biggest downside to getting a Class 2 Manufacturer License is the cost. The Type 7 FFL Costs $150 every 3 years, the Class 2 SOT costs $500 every year, and the ITAR fee can be as much as $2,250 per year. ITAR is a Tariffs & Regulations fee, which is a hot topic of conversation by manufacturers. Some people say you don’t need to pay the fee unless you export firearms, some say you have to pay the fee no matter what, and some say it depends on the number of firearms you manufacture. |

| Finding a definite answer in the ATF literature is nearly impossible, so your best bet is to contact an ATF agent and ask them directly. The ATF Agent we work with says that the ITAR fee is only required if you actually sell machine guns to a law enforcement agency. And then, it is not a flat fee, but rather it is based on the total amount of machine gun sales. |

| If you are interested in getting your Federal Firearms License, click below and we will help you out. |

| |

|

| Get your Federal Firearms License Now |

| |

|